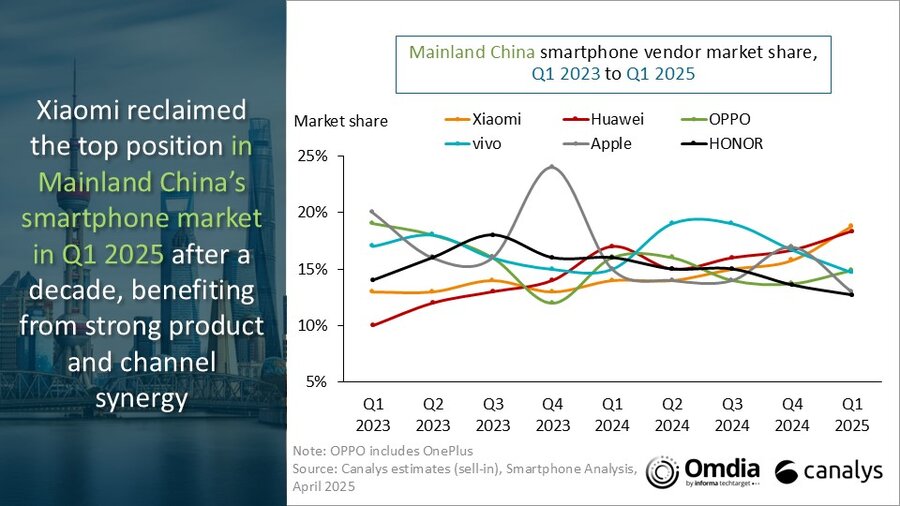

Xiaomi broke its decade-long drought to reclaim the number one spot in China’s market for smartphones with its recent market analysis provided by Canalys. Xiaomi’s strategic focus on product development as well as its optimized channels have pushed it ahead of its competitors for the first time in 2025 Q1, a turn of tide for the competitive market of smartphones in China.

China’s Smartphone Market Continues to Recover

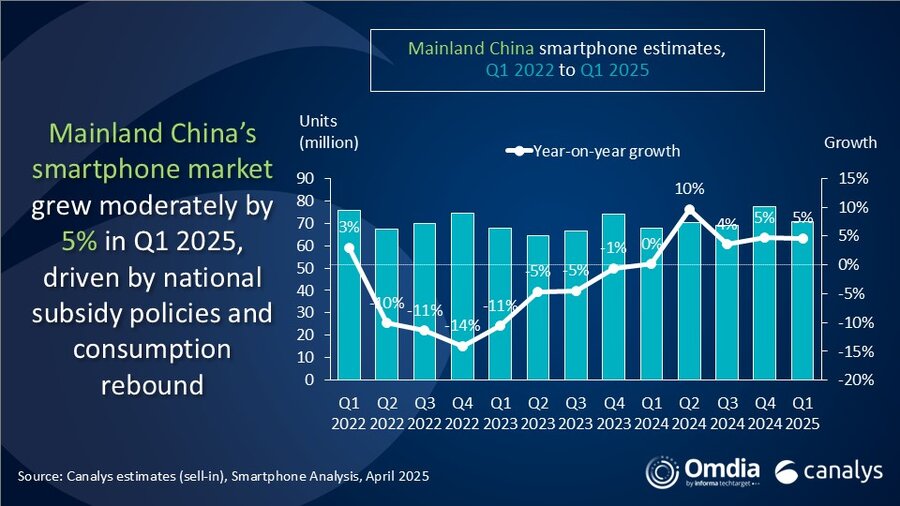

China’s first quarter of 2025 recorded 70.9 million smartphones shipped, a 5% growth year-on-year. This modest growth was a continuation of the improvement trend starting 2024, underpinned by:

- Government subsidy policies influencing buyers’ decisions

- Recovery of general consumption throughout the Chinese market

- Heightened need for refined devices with more sophisticated features

- Post-pandemic revival of physical retail channels

The market leaders are in Q1 2025

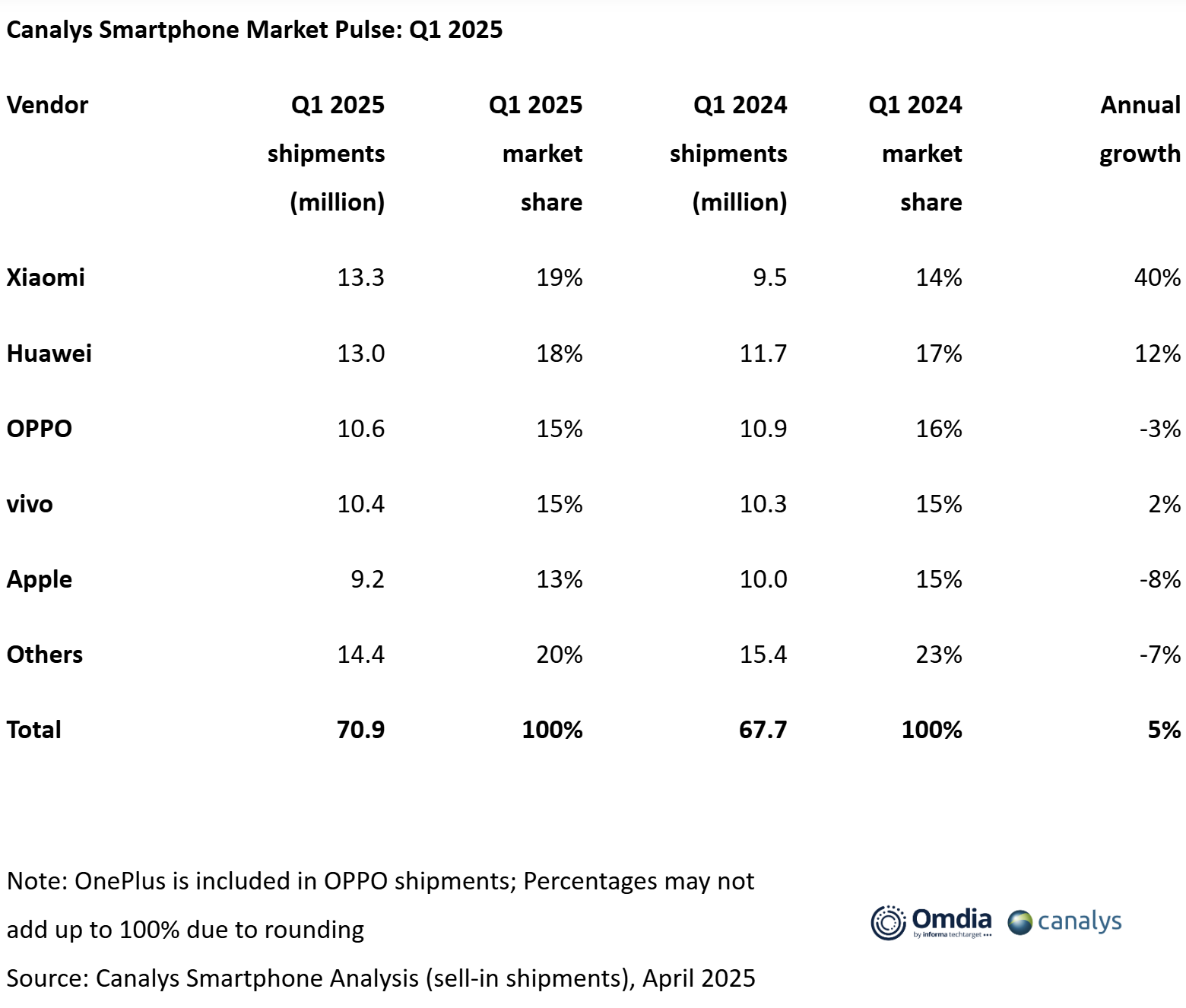

The competitive dynamic has been altered considerably with Xiaomi’s emergence:

- Xiaomi: 13.3 million units (19% market share, 40% year-over-year)

- Huawei: 13.0 million units (registering double-digit growth)

- OPPO: 10.6 million units

- vivo: 10.4 million units

- Apple: 9.2 million units (8% YoY decline)

Xiaomi’s Winning Strategy

Xiaomi’s strong performance can be linked to a number of reasons, according to Canalys Chief Analyst Zhu Jiatao. Xiaomi has applied a unified pricing scheme through online and offline mediums, successfully decreasing the cost of decision-making for consumers under government subsidy schemes.

Moreover, Xiaomi’s product framework covering a wide range of product categories maximized the advantages of government subsidies:

- Wearable devices

- Personal computers

- Smart home products

- Electric vehicles

Xiaomi’s diversified product portfolio has helped it to promote multi-scenario bundling consumption, establishing a virtuous circle of growth for its products.

Competitive Landscape

As Xiaomi is celebrating a comeback to the pinnacle, Huawei is proving resilient with sustained double-digit growth through efficient channel management and innovative products such as the Mate XT and Pura X foldables. Strategically, Huawei is accelerating development of its HarmonyOS Next ecosystem, which analysts see picking up 3% of China’s phone market by year’s end.

Source: Canalys

Emir Bardakçı

Emir Bardakçı

what a nice company and nice products

Imagine how much revenue and units xiaomi would sell if they offered all of their phones to the global markets.

this ridiculous nepotism rolls on. it reflects A vast level of immaturity never before seen by this person. (picture of John Lennon if available)

iam using xaomi mobile from 15 year’s

now mobile durability and battery backup is very good.main display quality . battery is hilight

this brand is just good.especially Xiaomi 12 .mmmmm the provision of second space.