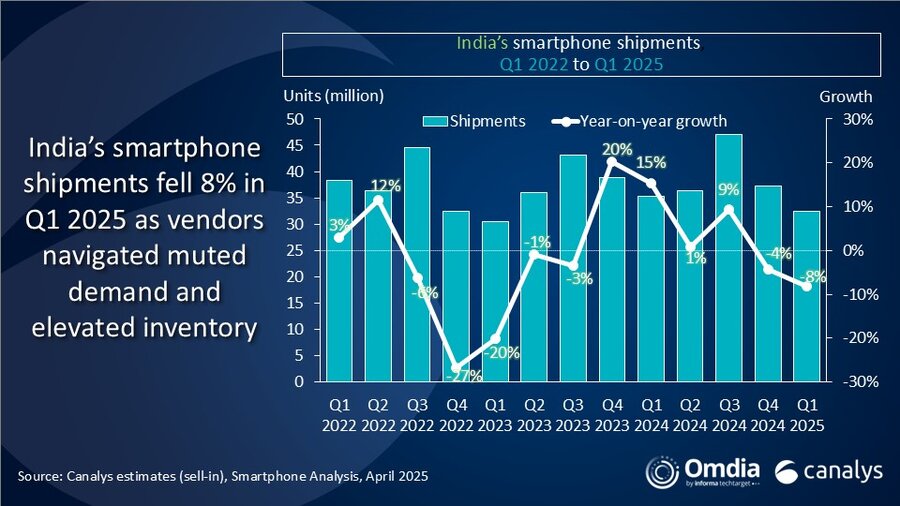

The Indian smartphone industry has witnessed a major slump during the first quarter of 2025, with total shipments dropping by 8% annually to the tune of 32.4 million units, based on the most recent market analysis. The slump is largely due to ongoing poor demand from consumers as well as leftover channel stock from the end of 2024.

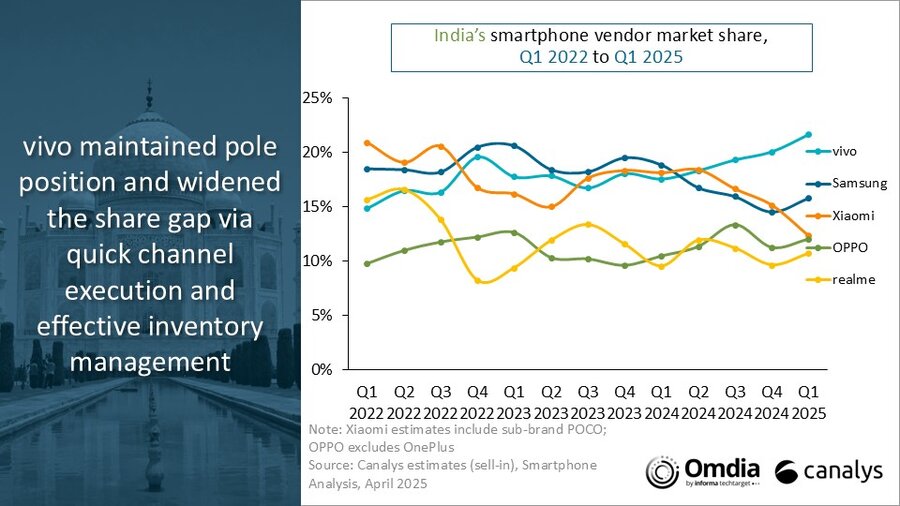

Xiaomi, a former market leader, has been hit especially hard with its shipment plummeting drastically by a whopping 38% year-over-year, relegating the company to third spot after Vivo and Samsung. In light of these difficulties, Xiaomi is nonetheless expanding its product portfolio in a bid to win back market share.

Q1 2025 Indian Smartphone Market Rankings

The present standings within the Indian smartphone market reflect dramatic changes from the past quarters:

- Vivo: 7 million units shipped (22% market share, +13% YoY)

- Samsung: 5.1 million units shipped (16% market share, -23% YoY)

- Xiaomi: 4 million units shipped (12% market share, -38% YoY)

- OPPO: 3.9 million units shipped (12% market share, +5% YoY

- realme: 3.5 million units shipped (11% market share, +3% Yo

Market Dynamics and Future Outlook

Industry experts predict that for smartphone manufacturers dealing in India, 2025 will continue to be tough. With organic consumer demand being slow, companies are relying more on retail and distribution channels to influence sales growth.

Sanyam Chaurasia, Canalys’ senior analyst (who is now a part of Omdia), offered some comments on the prevailing market situation, indicating that vendors will need to rely on channel incentive programmes, offline campaigns, as well as collaborative selling approaches in order to compete aggressively for market share within these trying times.

The strategy of Xiaomi moving forward

In spite of a considerable year-over-year decline, Xiaomi is engaging in several efforts to restore the Chinese company’s foothold in the Indian market. The organization is concentrating on:

- Renewing its range of products at different price ranges

- Expanding offline store presence

- Implementing competitive channel incentives

- Using its ecosystem offerings to build brand loyalty

The move is intended to stem the present decline and allow Xiaomi to regain its former strength in one of the world’s most significant smartphone markets.

Source: Canalys

Emir Bardakçı

Emir Bardakçı

![Update life of Xiaomi, POCO, REDMI devices: Full list [February 2026] 6 HyperOS 2](https://xiaomitime.com/wp-content/uploads/2025/03/HyperOS-2-300x163.jpg)

bring xiomi 15 to mid range price

i am sure this may have something to do with the awful and shambolic uodate rollouts. people lose faith when treated so awfully and when other smart ohone OS rollout software updates efficiently?? you cant trust xiaomi

i use xiaomi phone start from 2014 until 2023.. in the mean time i also use samsung or iphone for few month just to test how good their are but i always coming back to xiaomi.. but late 2023 i just cannot accept anymore and now im using infinix.. the same infinix i buy from late 2023 note 30 pro.. whats problem with xiaomi? every xiaomi phone that im using cannot last even a year.. 7-8 month you can feel how slugish they become.. lagging here and there.. midrange and same goes to flagship.. this infinix note 30 pro feel same as the first day i bought it.. smooth, zero issue and feel like premium midrange.. in a few month this phone will be 2 years and still kickin.. i really hope that xiaomi really make a good phone like this.. sorry xiaomi..

lousy phone. hyperos is the most UI android unfriendly os!

My Xiaomi 14T drops calls frequently and shows very weak signal reception. I am in Canada, any ideas as to why? Any advice would be appreciated.

It’s probably also because of bootloader unlocking, let them enable it and profits will go up significantly.