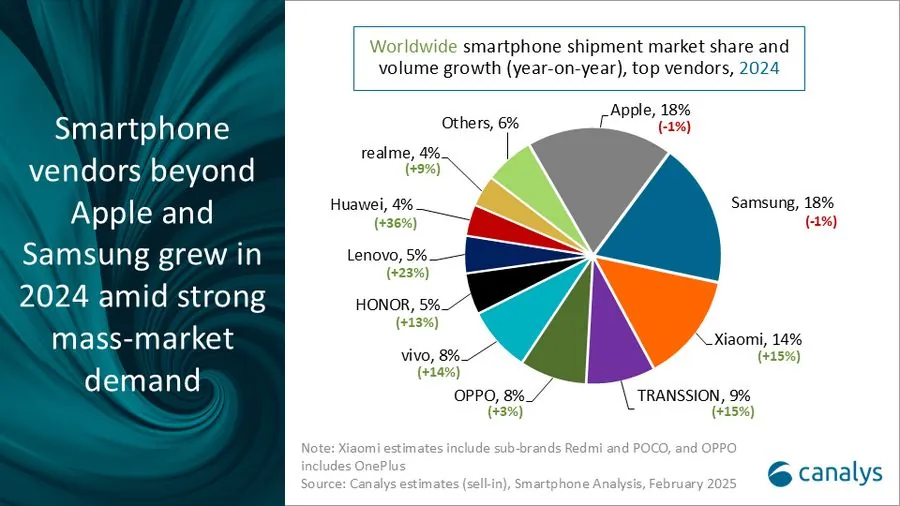

According to a February 3 Canalys report, smartphone shipments worldwide will grow 7% in 2024 to 1.22 billion units in a strong post-pandemic rebound following two years of sequential decline, boosted by post-pandemic replacement cycles, mass-market demand, and stocking

Apple Maintains Lead Despite Slight Decline

Apple retained its position at the leading smartphone brand with 225.9 million shipments in 2024. Yet, it is a 1% drop in annual sales, with most of it stemming from trouble in the Chinese market. In spite of that, robust sales in North America and in Europe kept Apple’s position afloat.

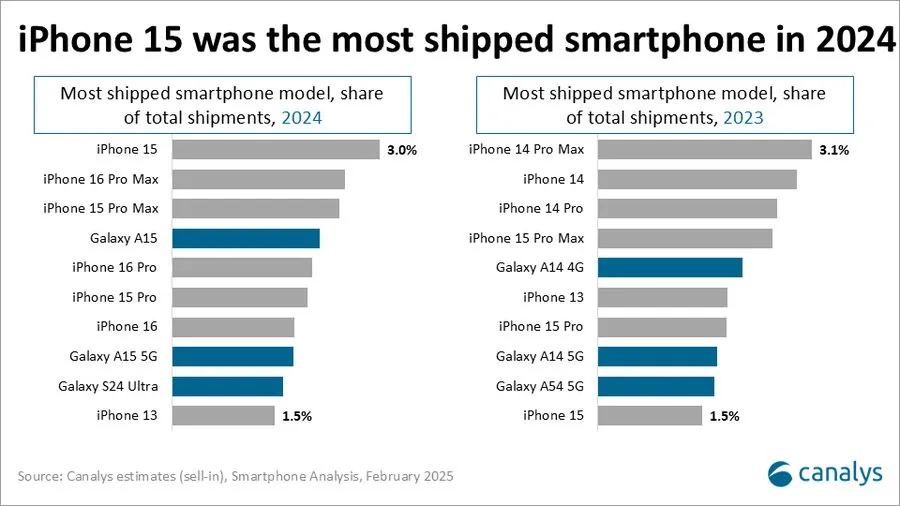

Consumers are increasingly opting for high-end iPhones, with iPhone 16 Pro and Pro Max seeing 11% more shipments compared to its iPhone 15 series counterparts at over 55 million units.

Samsung Grabs Second Spot with a Turn towards Profitability

Samsung followed closely with 222.9 shipments, a 1% annual fall, too. It maintained a profit-first model with its flagship Galaxy S series having its best sales in 2019. The Ultra model accounted for an increasingly larger proportion of Samsung’s high-end smartphone sales.

Xiaomi Logs Best Growth, Gains Strength in Marketplace

Xiaomi reported having seen the biggest shipment growth of any flagship smartphone maker, with a 15% annual growth to 168.6 million units.

- Strong sales in China

- Expansion in emerging economies

Xiaomi now holds the third position in terms of sales of smartphones worldwide, confirming its position in a leadership position in its sector.

Transsion Enters the Top Four for the First Time

Transsion, a company famous for its stronghold in African and South Asian markets, reached a historic high in its position, becoming fourth in the world. With 106.7 million shipments (a 15% YoY rise), it overtook OPPO for the first time ever.

Meanwhile, OPPO (which includes OnePlus) ranked in fifth position with 103.6 million and a 3% increase over 2023.

Q4 2024 Smartphone Market Performance

Canalys also shared data for Q4 2024 smartphone shipments:

| Manufacturer | Q4 2024 Shipments (Million Units) | Market Share (%) | Q4 2023 Shipments (Million Units) | Market Share (%) | Growth (%) |

|---|---|---|---|---|---|

| Apple | 77.1 | 23% | 78.1 | 24% | -1% |

| Samsung | 51.9 | 16% | 53.5 | 17% | -3% |

| Xiaomi | 42.7 | 13% | 40.7 | 13% | 5% |

| Transsion | 27.2 | 8% | 28.5 | 9% | -4% |

| Vivo | 26.4 | 8% | 23.9 | 7% | 10% |

| Others | 102.7 | 32% | 94.5 | 30% | 4% |

| Total | 328.0 | 100% | 319.2 | 100% | 3% |

2024 Full-Year Smartphone Market Performance

| Manufacturer | 2024 Shipments (Million Units) | Market Share (%) | 2023 Shipments (Million Units) | Market Share (%) | Growth (%) |

|---|---|---|---|---|---|

| Apple | 225.9 | 18% | 229.1 | 20% | -1% |

| Samsung | 222.9 | 18% | 225.5 | 20% | -1% |

| Xiaomi | 168.6 | 14% | 146.1 | 13% | 15% |

| Transsion | 106.7 | 9% | 92.6 | 8% | 15% |

| OPPO | 103.6 | 8% | 100.7 | 9% | 3% |

| Others | 395.4 | 33% | 347.9 | 30% | 14% |

| Total | 1,223.1 | 100% | 1,141.9 | 100% | 7% |

The global smartphone market remains in recovery in 2024, having experienced two roller coaster years. Apple and Samsung, nevertheless, retain a leadership position, but new challengers in the form of Xiaomi’s high growth and Transsion’s position in the top four represent new trends in the marketplace. With increased competition and demand for high-end smartphones, the smartphone marketplace is in for an exciting future. What are your thoughts on these latest market trends? Let’s discuss!

Emir Bardakçı

Emir Bardakçı