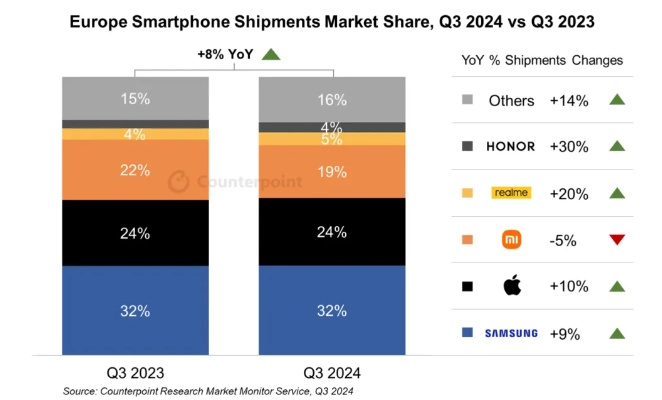

A new report by Counterpoint Research shows clear signs of recovery in the European smartphone market for the third consecutive quarter of 2024. Shipments grew by 8% year over year, due to recovering macroeconomic conditions, returning consumer demand, and settling smartphone makers after the crash of 2023. Meanwhile, though the overall market increased, Xiaomi continued to remain the third-largest smartphone manufacturer in Europe, showing resistance with a slight YoY decline in shipments.

Market Highlights: Xiaomi Among Top Three

- Samsung: Maintained the top position, while growing 9% year-over-year.

- Apple: The company took second place, with shipments up 10% compared to a year ago.

- Xiaomi took third place, with shipments falling 5% year on year, but it remains one of the key players in the European market.

- Realme: Has put up a good momentum with 20% growth.

- Honor: Surpassed the competition with an exceptional 30% increase.

Xiaomi’s Contribution to Recovery in the European Market

Though there is, in fact, a decline, it would seem it is minor because the consistency Xiaomi has been showing in the creation of new products and offering those at cheap prices has turned their favor among European clients. A great portfolio of high-end devices, like the ones in the Xiaomi 14 series, to budget, helped the brand retain aggressiveness in such an inclined market.

Central and Eastern Europe, recovering strongly, was up 17% year-on-year; Western Europe has continued to see consistent growth for Xiaomi. Indeed, strong sales of its budget yet full-featured devices in these regions complement the steady performance of the company in Western Europe.

Challenges and Opportunities Ahead

Competition is still alive in the European market, with other manufacturers like Honor and Realme continuing to show double-digit growth. But Xiaomi is better placed to use impending innovations-rollo ut of HyperOS 2 globally and the launch of the Xiaomi 15 Ultra-to its advantage to further consolidate its position in Europe. Besides, with the further improvement of the macroeconomic environment, it is inevitable that Xiaomi’s strategy of offering high-quality devices at competitive prices will retain its appeal to cost-conscious consumers.

Consumer Confidence on the Rise

As noted by Jan Stryjak, Associate Director at Counterpoint Research, the recovery of this market has been pretty significant:

Three consecutive quarters of growth again point to the fact that consumer confidence is recovering after a difficult 2023.

Although Xiaomi struggled in Western Europe due to increasing competition from Samsung, Apple, and others, this performance in Central and Eastern Europe underlined the company’s ability to adapt to regional demands.

While there is a slight setback in the Q3, 2024 shipment number, Xiaomi remains strong in Europe. With a range of product launches and innovations lined up, it should capture the upward momentum for the European smartphone market. At the time of the bounce-back of the industry, its drive for affordable innovation would continue to keep Xiaomi relevant and assure growth in the region. Stay tuned for further steps from Xiaomi, as it continues to set benchmarks with its leading-edge technologies and user-first attitude in 2024 and beyond.

Emir Bardakçı

Emir Bardakçı